Covid-19 Impact on Taxes: Support and Relief Measures

Considering the coronavirus outbreak the Portuguese Government decided to adopt a broad package of measures destined at relieving the tax pressure on families and companies.

- Corporate income tax return submission deadline extension

The deadline for submitting the corporate income tax return for 2019, which was initially scheduled for May 31 2020, has been extended to July 31 2020.

Taxpayers may submit their tax returns within the new deadline without any additional payments or penalties.

- Corporate income tax payment deadline extension

The first special payment on account, which was due by March 31 2020, may be made until June 30 2020.

The deadline for the first payment on account and first additional payment on account has been extended from July 31 to August 31 2020.

- Payment in instalments of taxes due on the 2nd quarter (VAT, and income withholding taxes)

VAT, personal income tax withholding and corporate income tax withholding due on the 2nd quarter of 2020 may be paid in instalments without the need to provide a guarantee.

The taxpayer may opt to pay in 3 monthly and successive instalments without any additional interest or in 6 monthly and successive instalments also without interest.

This option applies to the following entities:

- companies and self-employed persons with a turnover of up to EUR 10 million in 2018;

- companies and self-employed persons starting their activities as from 01/01/19;

- companies and self-employed persons who have re-started their activity on or after 01/01/19, when they have not achieved turnover in 2018;

- irrespective of the above, companies in the following sectors:

a) recreational, leisure and entertainment activities;

b) cultural and artistic activities and sporting activities, except if destined to the activity of high performance athletes;

c) activities in open spaces, public spaces, streets and private spaces of public use;

d) gambling;

e) catering;

f) spas and equivalent.

Companies and self-employed persons with a turnover of more than EUR 10 million in 2018 may also opt for the payment in instalments provided that they record a turnover decrease reported through the E-Fatura of at least 20% in the average of the 3 preceding months as compared to the same period of the previous year. The decrease in the turnover must be certified by a certified auditor or accountant.

The request for payment in monthly instalments shall be submitted by electronic means until the legal deadline for the payment of the tax obligation.

The monthly instalments for the benefit plans shall be due as follows:

- the first instalment shall be paid on the date of fulfilment of the tax obligation;

- the remaining instalments shall be paid on the same date of the following months.

Examples:

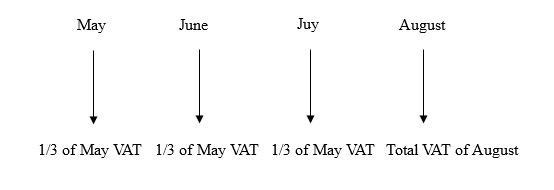

For a payment plan in 3 installments of a VAT taxable person in the quarterly VAT scheme, the payment obligations would be as follows:

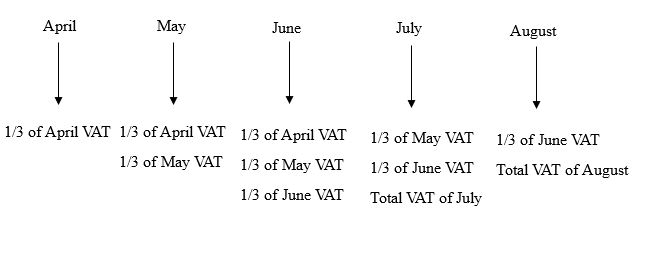

For a payment plan in 3 instalments of a VAT taxable person in the monthly VAT scheme, the payment obligations would be as follows:

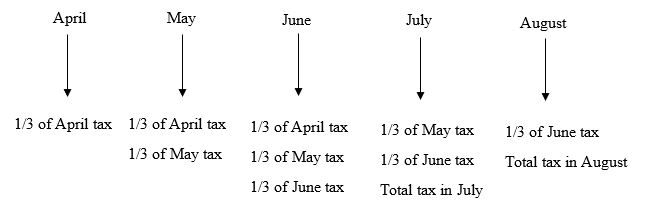

For a payment plan in 3 instalments of income tax withholding, the payment obligations would be as follows:

- Social security contributions deadline extension

As regards social security the new measures also allow for the deferment of the relevant payments.

This option has been made available for companies which meet the following requirements:

- have less than 50 employees;

- have between 50 and 249 workers, provided that provided that they record a turnover decrease reported through the E-Fatura of at least 20% in the average of March, April and May as compared to the same period of the previous year or, for those which started the activity less than 12 months ago, to the average of such period;

- have 250 or more workers, provided that they record a turnover decrease reported through the E-Fatura of at least 20% in the average of March, April and May as compared to the same period of the previous year or, for those which started the activity less than 12 months ago, to the average of such period, and are in one of the following situations:

a) are a private charity or similar;

b) pursue an activity that falls within of the following sectors:

i) recreational, leisure and entertainment activities;

ii) cultural and artistic activities and sporting activities, except if destined to the activity of high

iii) performance athletes;

iv) activities in open spaces, public spaces, streets and private spaces of public use;

v) gambling;

vi) catering;

vii) spas and equivalent.

c) their activity has been suspended

The invoicing requisites in the cases foreseen in paragraphs 2. and 3. above shall be demonstrated by the company in July 2020, together with the certification of the company’s certified accountant.

The payments of the contributions due shall be made as follows:

- 1/3 of the amount in the month in which it is due;

- the remaining 2/3 shall be paid in equal and successive instalments in the months of July, August and September 2020 or in the months of July to December, without any interest or the need to provide guarantee.

Regarding the companies that have already paid in full the contributions due in March, the contributions due in April, May and June may be paid in 1/3.

As for the companies that have already applied the 1/3 contributions payment in March, the same option may only be applied for the contributions due in April and May. Thus, the contributions due in June shall be paid in full.

This measure is optional to employees and is not subject to prior application or approval.

Non-compliance with the instalment payments results in the revocation of the benefit and of the interest exemption.

Suspension of tax enforcement proceedings and payment plans

Tax enforcement proceedings, as well as ongoing payment plans regarding debts to the Tax Authority and Social Security are automatically suspended at least until June 30 2020.

For more information please contact us at: jcg@ccsllegal.com

[Photo: Ryoji Iwata, available at: unsplash.com]